IADA Reports Strong Preowned BizJet Sales and Optimistic Forecast for 2025

LOS ANGELES, CA, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- The International Aircraft Dealers Association (IADA) concluded 2024 with a rise in preowned business aircraft sales and an optimistic outlook for the year ahead.

These results, along with robust market confidence, are detailed in IADA’s Fourth Quarter 2024 Market Report, released today. IADA dealers completed 1,559 transactions in 2024 while the fourth quarter alone saw 562 aircraft deals finalized.

Post-Election Clarity Boosts Confidence

“Our fourth quarter 2024 perception survey indicates that members are entering 2025 with a collective sense of optimism. Expectations are high that the incoming U.S. Administration and Congress will enact policies favoring business growth and opportunity,” said IADA Chairman Phil Winters, Vice President of Aircraft Sales and Charter Management at Greenwich AeroGroup and Western Aircraft. “This optimism is reflected in the anticipated strong demand for preowned aircraft across all size categories, supported by relatively stable prices, values, and additional inventory,” he added.

"With post-election clarity in the U.S., market confidence has strengthened, leading to healthy sales projections and optimistic financial forecasts,” said IADA Executive Director Lou Seno. “IADA dealers handle over 50% of global preowned business aircraft transactions, cementing our members' position as authoritative transaction leaders that define the market.”

New Acquisition Agreements:

130 new agreements were signed in the last 90 days of 2024, up 3% year-over-year from the fourth quarter of 2023.

For the full year 2024, 1,176 agreements were signed, a 39% increase compared to 846 in 2023.

Exclusive Retainer Agreements:

Dealers signed 207 exclusive retainer agreements in the fourth quarter of 2024, consistent with 2023 levels.

Online Marketplace Growth:

Leads generated through AircraftExchange, IADA’s exclusive online marketplace, grew by 34% year-over-year in 2024, reflecting increased traffic and engagement from highly qualified buyers.

Deal Volume:

The fourth quarter of 2024 witnessed a 49% sequential increase in closed deals compared to the third quarter and slightly exceeded fourth quarter 2023 results.

For the full year 2024, IADA dealers reported a total of 1,559 closed deals, up 10% year-over-year from 1,421 deals in 2023, supported by a larger number of reporting dealers.

Market Trends and Challenges

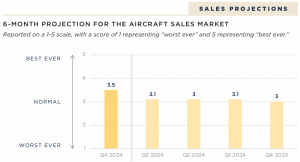

The IADA Fourth Quarter 2024 Member Perception Survey indicates heightened optimism among members about the preowned business aircraft market. Respondents anticipate a pro-business, pro-growth approach from the incoming U.S. Administration, further bolstering optimistic expectations for aircraft deal making over the next six months.

While market optimism reigned supreme in the fourth quarter of 2024, supply-side issues continue to constrain preowned transaction volumes and velocities. Supply chains and manpower pools have yet to rebound, with signals that factory deliveries continued to slide into 2025.

In 2025, a combination of market optimism, U.S. business-friendly policy, additional preowned aircraft supply, and general price stability should support a relatively healthy retail transaction environment for preowned aircraft. The IADA Perception Survey provides crucial insights into market trends, helping members and stakeholders navigate the evolving landscape with confidence.

For the full market report, visit AircraftExchange.

Market Comments from IADA Members

Following are member comments from the perception survey.

Uptick in transactions following the election as expected. We expect Q2 2025 to be strong. - RICHARD MCEACHIN, AVIATION LEGAL GROUP, P.A. // IADA VERIFIED PRODUCTS AND SERVICES MEMBER

The aviation insurance market has been ‘softening’ in some business sectors over the last 6-12 months. As such the segment is now favoring the consumer more so than over the last 4-5 years time with market options and softening pricing models used by insurers in the space. - TOM HAUGE, WINGS INSURANCE // IADA VERIFIED PRODUCTS AND SERVICES MEMBER

Although pre-owned aircraft inventory levels have been on the rise, there is certainly pent-up demand that has resulted from the relative pause we saw in the market throughout 2024 leading up to the presidential election. - SHAWN HOLSTEIN, HOLSTEIN AVIATION, INC. // IADA ACCREDITED DEALER

Market conditions and pricing are stable. Transaction volume is solid; not great but not bad. Pricing is stable and will continue to be so at the current demand levels provided OEM backlog is consistent at +/- current levels. - ERIC ROTH, INTERNATIONAL JET INTERIORS // IADA VERIFIED PRODUCTS AND SERVICES MEMBER

Market is generally pretty good, better demand for newer, lower total time aircraft. - RENE CARDONA, DUNCAN AVIATION, INC. // IADA ACCREDITED DEALER

Activity remains strong right now. Depending on the course the new administration takes, increased activity could be possible. - CARY FRIEDMAN, EAGLE AVIATION. // IADA ACCREDITED DEALER

The market is solid, with good activity across all regions - Europe, Africa, Middle East, Asia and the Americas. Each region has its preferences and peculiarities, but buyers are performing at present. - ZIPPORAH MARMOR, OPUS AERO // IADA ACCREDITED DEALER

Right or wrong, the election results are perceived to be pro-business which should benefit our industry over the coming years. Market activity has immediately surged in anticipation of a positive growth, tax-friendly environment. - DAVID MONACELL, CFS JETS // IADA ACCREDITED DEALER

Q4 pre-owned market conditions are reasonably strong although balanced in comparison to the last 3 years. Inventory is increasing across the board, but absorption remains across most market segments. - SCOTT OSHMAN, OSHMAN AVIATION // IADA ACCREDITED DEALER

Market conditions have more tailwinds than headwinds. This is continuing to make it more difficult than not to f ind quality aircraft at a market price. Older aircraft that are not modernized are having a very tough time. - SHAWN DINNING, DALLAS JET INTERNATIONAL // IADA ACCREDITED DEALER

Having the US election results known has created a remarkable confidence level in the largest market worldwide. The rest of the global market is catching up to what this means, and candidly so are many of us. But the confidence level we’ve seen and has been measured by others (JetNet specifically) is very high. - CHAD ANDERSON, JETCRAFT // IADA ACCREDITED DEALER

Optimism is increasing in the aviation market quickly. - SHAWN HOLSTEIN, HOLSTEIN AVIATION, INC. // IADA ACCREDITED DEALER

Values are tempering a bit. - GORDON RAMSAY, LONE MOUNTAIN AVIATION // IADA ACCREDITED DEALER

Normally we should be in full rush mode for the end of the year transactions, we are not seeing that yet. Most of our clients believe that the tax incentives will be more advantageous if they wait until next year. - JOHN SWARTZ, SWARTZ AVIATION GROUP, LLC. // IADA ACCREDITED DEALER

Older airplanes ( >24 years old) will continue to lose hull values as engine issues, obsolescence and aging aircraft all drag the values down. - JOHN JELOVIC, DASSAULT FALCON JET // IADA OEM MEMBER

2025 is going to be an excellent year for transaction activity. Clients are engaged in reshaping their flight departments and our new and preowned acquisitions business remains robust. Headwinds are really coming mostly from OEM delivery schedule challenges and slippage. Flight departments that are forward looking should get ahead of delivery curves and not procrastinate on ordering the next plane. Parts support to keep existing fleets flying has not kept up with the needs of the operators, and that is a problem that needs solving. - JIM RINER, WETZEL AVIATION // IADA ACCREDITED DEALER

Now that the election is behind us the market seems to be recovering into a somewhat stable condition. I think once we start to see what the Trump 2.0 administration will look like, we will have a clearer picture of what the next 1-3 years may bring. But overall, I think it will be positive for aircraft sales. - MITCH PISHKO, HONDA AIRCRAFT COMPANY // IADA OEM MEMBER

Remains to be seen how the first 100 days of the new administration plays out, but gut feel is market conditions will improve. - JOSEPH CARFAGNA, LEADING EDGE AIRCRAFT SOLUTIONS // IADA ACCREDITED DEALER

Today’s market conditions remain dynamic, with consistent demand for high-quality preowned aircraft, particularly in the turboprop, light to midsize jet segments. Inventory levels are gradually increasing, but pricing remains quite resilient for well-maintained, low-time aircraft. Buyers are becoming more selective, placing greater emphasis on maintenance history, engine programs, and avionics upgrades. - REBECCA FRANCIS, LEVAERO AVIATION // IADA ACCREDITED DEALER

About IADA

The International Aircraft Dealers Association (IADA) is a professional trade organization that sets the standard for excellence in the aircraft resale industry. IADA members are among the most experienced and respected professionals in the field, committed to maintaining the highest levels of integrity, transparency, and expertise. IADA-Accredited Dealers undergo rigorous vetting and continuous re-accreditation, ensuring that they meet the highest standards of professional conduct and service. For more information, visit https://iada.aero.

About AircraftExchange.com

IADA's AircraftExchange marketing search portal is the only site where every aircraft listed for sale is represented by an IADA-Accredited Dealer. AircraftExchange enables users to create a confidential dashboard of business jets for sale, filtered based on their features and amenities, class size, age, and price. Users can browse through data-rich listings for available business aircraft. For more info go to https://aircraftexchange.com.

Jim Gregory for IADA

James Gregory Consultancy llc

+1 316-706-9147

email us here

Visit us on social media:

Facebook

X

LinkedIn

Other

Distribution channels: Aviation & Aerospace Industry, Business & Economy, Companies, International Organizations, Travel & Tourism Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release